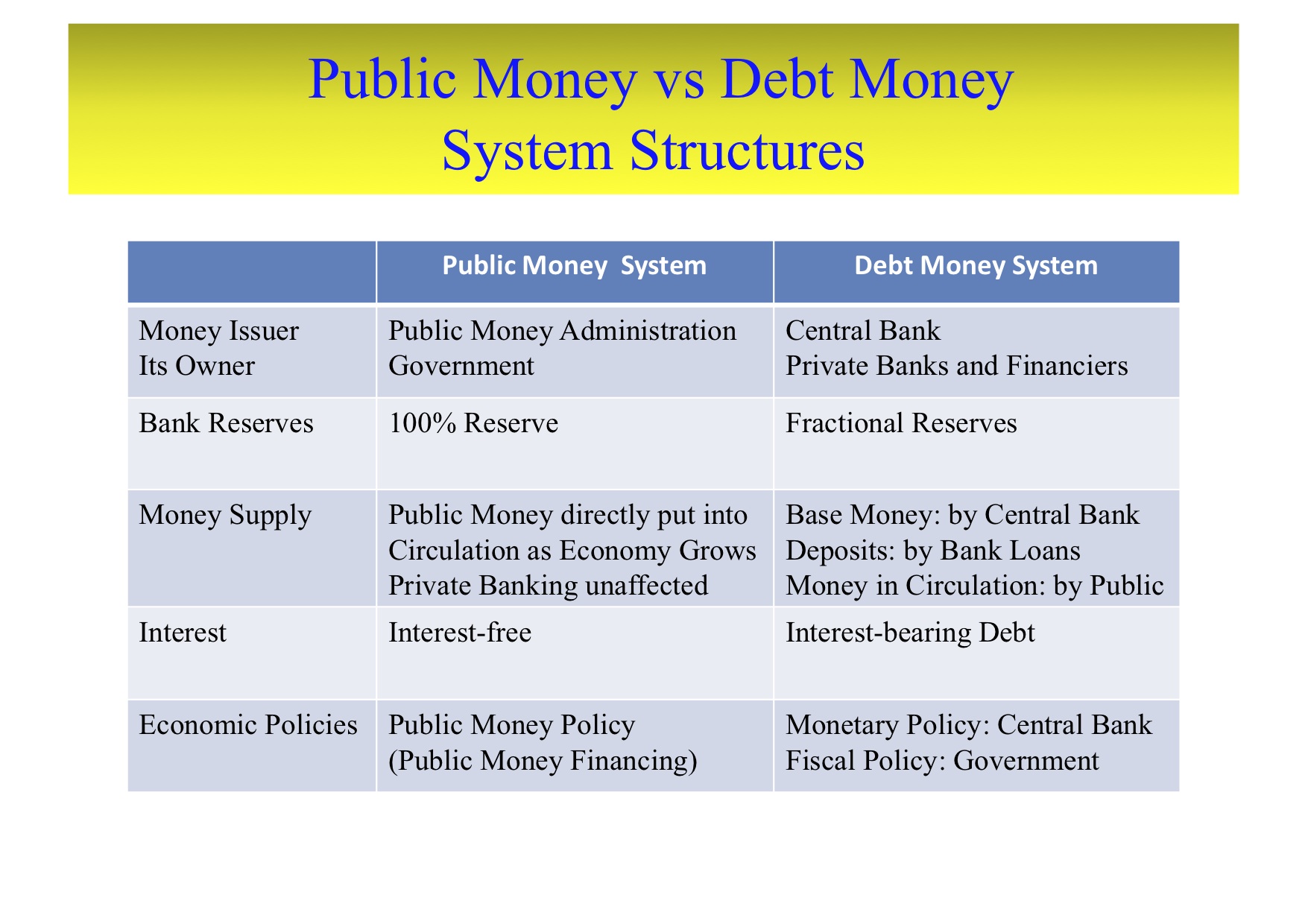

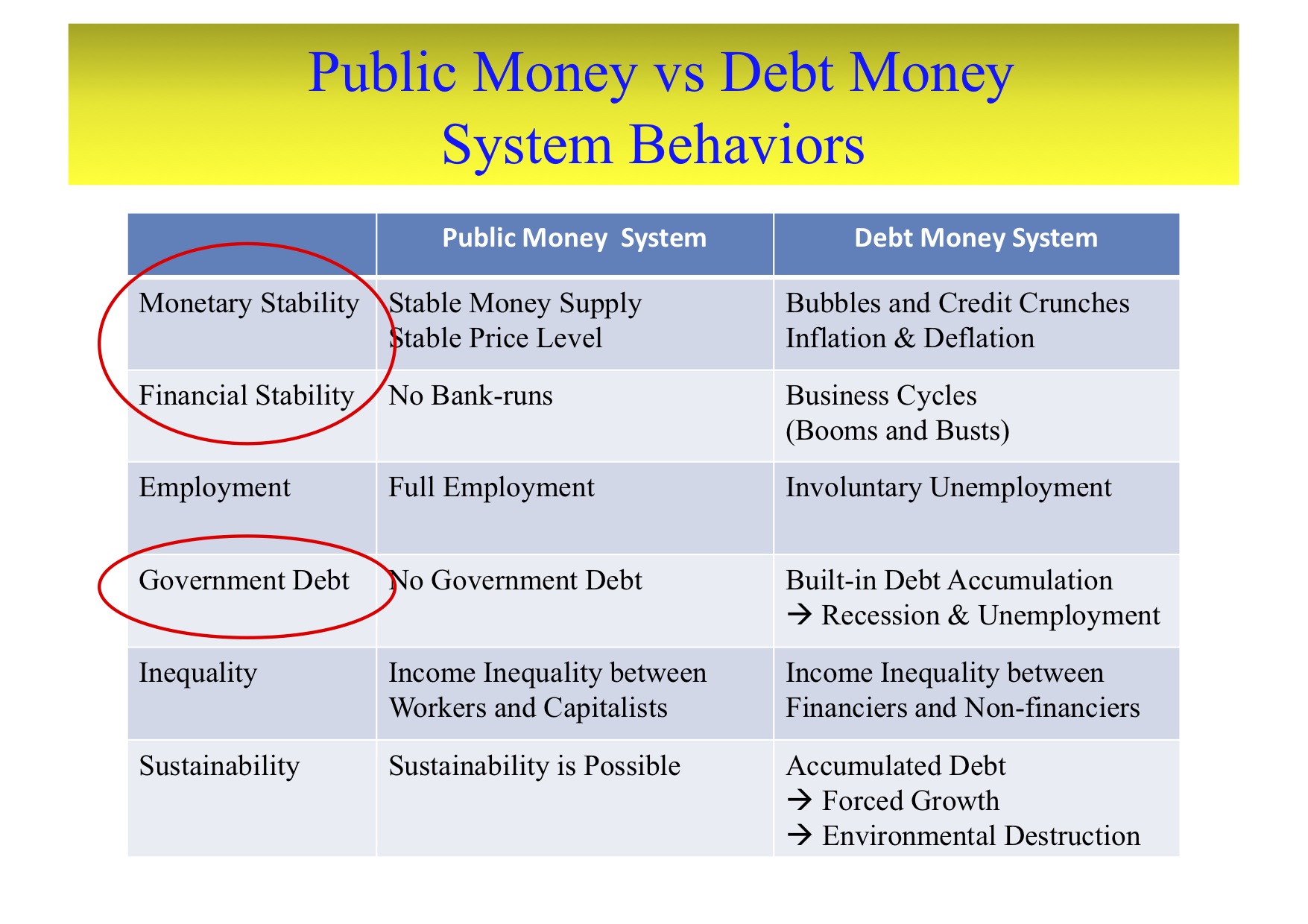

Tables below briefly summarize the structures and behabiors of these two systems. Please read Chapter 15 of my book: Money and Macroeconomic Dynamics, 2014, for the detailed comparative economic analyses.

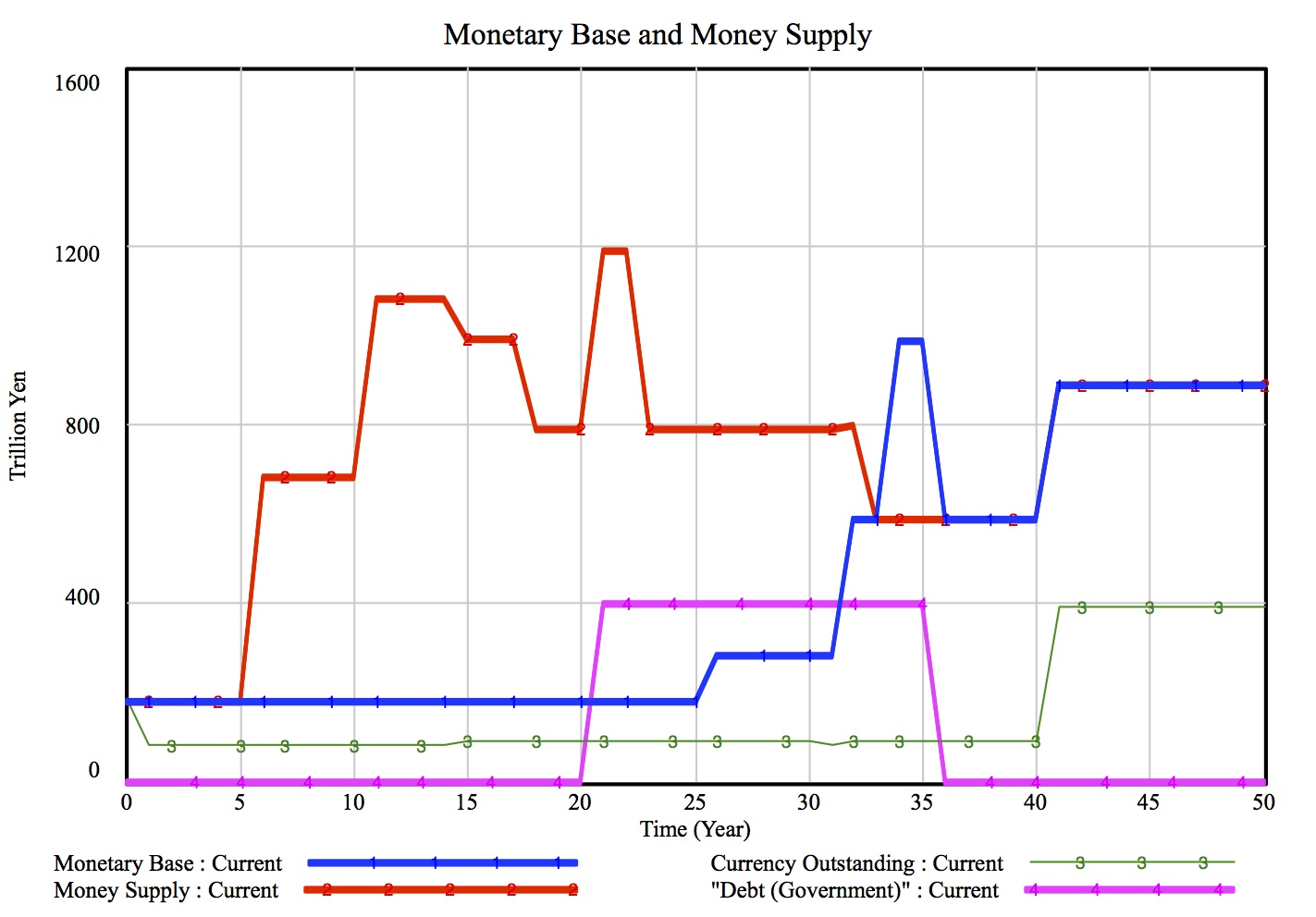

Transition Process to the Public Money System

The key idea of this transition is illustrated in the diagram below. The transition tries to unify the two separated lines of Monetary Base (line 1) and unstable Money Supply (line 2) into the stable Public Money Supply (line 1= line 2). Surely, Government Debt (line 4) is liquidated. My paper on the transition process from the Debt Money System to the Public Money System, presented at the 32nd International Conf. of the System Dynamics Society, Delft, Netherlands, July 22, 2014, is now available to those who are interested in this transiton process in detail.

Years 0 - 30: Volatile Money Supply under the Debt Money System (Period of Booms and Depressions)

-- Monetary Base (line 1) is used to create unstable Money Supply (line 2) out of nothing.

Years 31 - 35: Transition Period

-- Bank Credits are converted to 100% money, and Government Debt (line 4) is liquidated

without causing inflation and chaos!

Years 36 - 50: Stable Money Supply under the Public Money System (Period of Sustainability and Peace)

-- Stable Money Supply (line 1 = line 2) is attained by unifying monetary base (line 1)

and money supply (line 2).

Related

Documents

(1) US Congressional Briefing 2011, July 26, 2011 by Prof. Kaoru Yamaguchi: TRANSCRIPT (This is a transcript of my US congressional briefing on the workings of the public money system)

* (1-Page Briefing Note for Media) (One page briefing note distributed to the Media)

(2) HR 2990 (NEED Act, National Emergency Employment Defense Act)

Congressman Dennis Kuchinich's Bill based on the American Monetary Act,

which is submitted to the US House Committee on Financial Services on Setp. 21, 2011.

(3) Workings of A Public Money System of Open Macroeconomies;

(Paper, Slides and YouTube) at the 7th Annual AMI Monetary Reform Conf.

University Center, Downtown Chicago, Sept. 30, 2011.

(4) A Program for Monetary Reform by Irving Fisher, etc., July 1939.

(Reformatted by the Kettle Pond Institute)

(This document is an extended version of the original "The Chicago Plan for Banking Reform" by Henry Simons, etc., March 16, 1933).

(5) On the Monetary and Financial Stability under A Public Money System;

( Paper, Slides and YouTube ) at the 8th Annual AMI Monetary Reform Conference, University Center, Downtown Chicago, Sept. 20 - 23, 2012.

(6) Public vs Debt Money Systems - the American Monetary Act in a Nutshell;

(Paper, Slides and YouTube) at the 9th Annual AMI Monetary Reform Conference,

University Center, Downtown Chicago, Sept. 19 - 22, 2013.

(7) From Debt Money to Public Money System - Modeling A Transition Process Simplified;

(Paper, Slides) at the 10th Annual AMI Monetary Reform Conference, University Center,

Downtown Chicago, Oct. 2 -5, 2014.

Related Videos

|

Interview

with Joe

at AMI Conf. 2010 |

Interview

with Joe at AMI Conf. 2011  |